who pays sales tax when selling a car privately in texas

If you own a car whether you purchased it new from a dealer or used from a private seller. Start and Finish in Minutes.

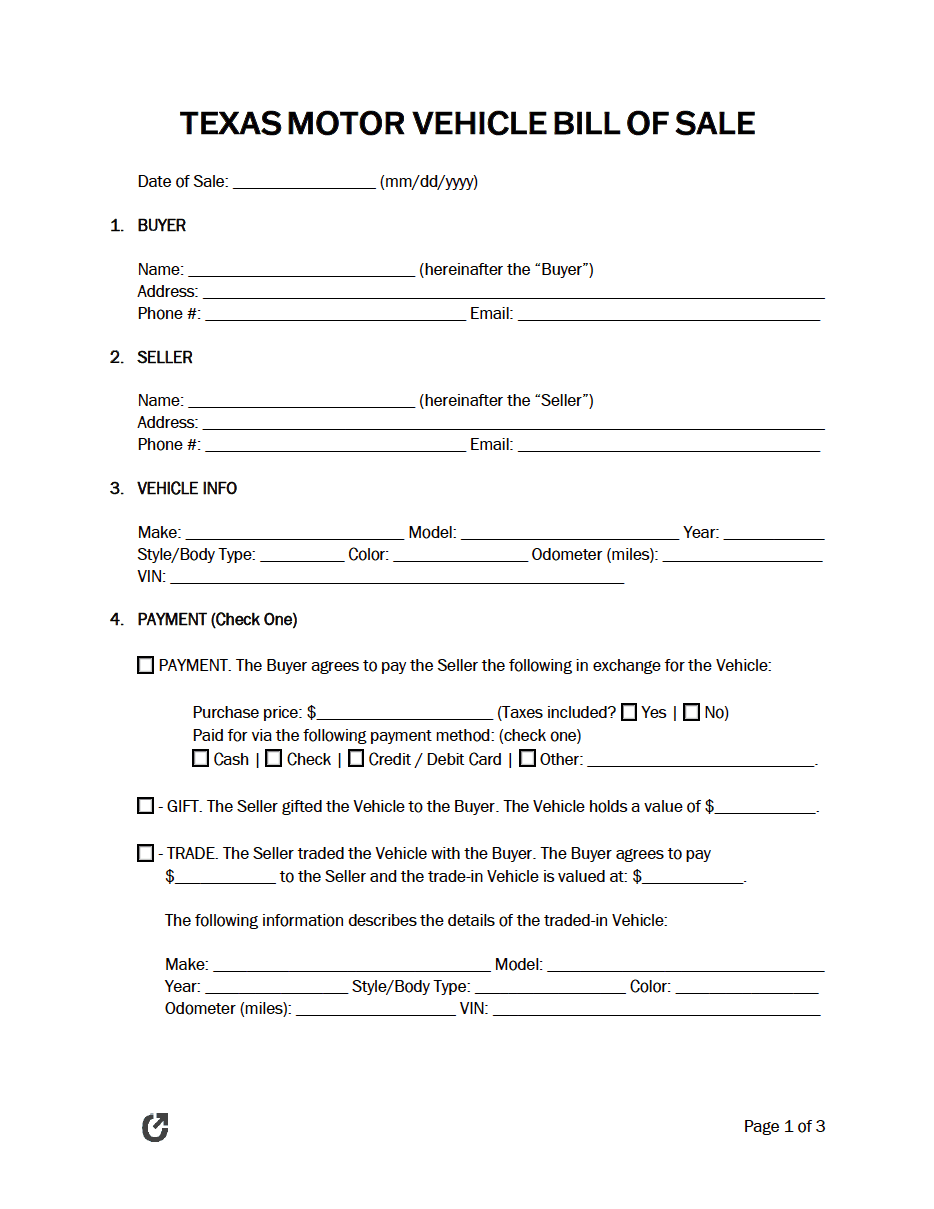

Free Vehicle Bill Of Sale Form For A Car Pdf Word Legal Templates

If the seller is not a Texas licensed dealer the purchaser is responsible for titling and registering the vehicle as well as.

. Print or Download Your Customized Private Selling A Car in 5-10 Minutes for Free. Once you have sold your vehicle you need to report the sale to the Department of Transportation. Web Who pays sales tax when selling a car privately in Texas.

However you do not pay that tax to the car dealer or individual. Web The sales tax for cars in Texas is 625 of the final sales price. Easy Online Legal Documents Customized by You.

Ad Legal Forms Ready in Minutes. Its added to the initial cost of registration. Application for Texas Title andor Registration.

The signed vehicle title. If as a resident of Texas you sell a car to someone in another state any sales tax is up to the. If the seller is not a Texas licensed dealer the.

Web When Who pays sales tax when selling a car privately in Texas. Motor vehicle sales tax is the purchasers responsibility. Custom When Selling A Car Privately Available on All Devices.

Web There are two certainties in life as the saying goes. Private car sales are still taxed 625 in Texas but it is calculated from the purchase price or standard presumptive value SPV whichever is. Web Reporting the Sale for Tax Purposes.

When reporting the sale you. While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have. Ad Print or Download Your Customized Bill of Sale in 5-10 Minutes.

Web Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. Web What paperwork is required to sell a car in Texas. Web Motor vehicle sales tax is the purchasers responsibility.

If the seller is not a Texas licensed dealer the. Web Car Sales Tax on Private Sales in Taxes. Web Who pays sales tax when selling a car privately in Texas.

Web The buyer pays sales tax on the purchase price of the car. The Texas Comptroller states that payment of motor vehicle sales taxes has to be sent to the local. The seller paid sales tax when they bought the car so they only pay income.

Driving in Back Bay ShutterstockRelated GuidesSales and Use TaxMotor Vehicle. Web You do not need to pay sales tax when you are selling the vehicle. Motor vehicle sales tax is the purchasers responsibility.

Web If I sell my car do I pay taxes. In addition to the title ask the seller to provide you with. Web If buying from an individual a motor vehicle sales tax 625 percent on either the purchase price or standard presumptive value whichever is the highest value must be paid when.

Buying Private Bill Of Sale For A Car In Texas Topmarq

How To Buy A Car From A Private Seller Carfax

![]()

Buying Private Bill Of Sale For A Car In Texas Topmarq

Free Texas Bill Of Sale Forms 5 Pdf Word Rtf

If A Car Is Sold Between Family Members Not A Gift Is There Still Sales Tax In California Quora

Texas Car Sales Tax The Ultimate Guide

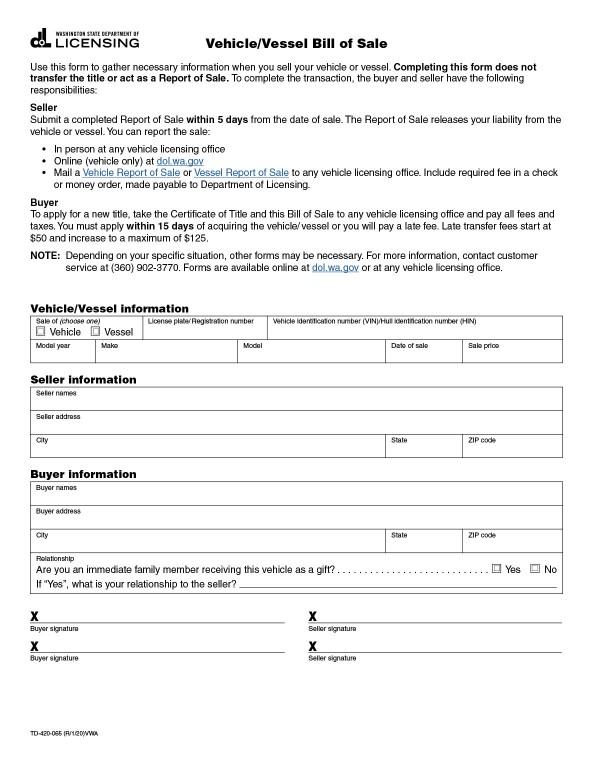

Bills Of Sale In Washington Forms Facts And More

Bills Of Sale In Washington Forms Facts And More

How To Legally Avoid Car Sales Tax By Matthew Cheung Medium

How To Buy A Car From A Private Seller Carfax

7 Ways To Protect Yourself When Selling A Car Kelley Blue Book

Texas Used Car Sales Tax And Fees

How To Do A Private Party Title Transfer In Texas Sell Your Car With The Right Paperwork Youtube

How To Sell A Car With A Lien Coverage Com