does td ameritrade provide tax documents

Jensen said the documents come in PDF format so you can view or download your statements from a computer laptop tablet or mobile device. TD Ameritrade does not provide tax advice.

Tax Season And More Made Simpler With The Td Amerit Ticker Tape

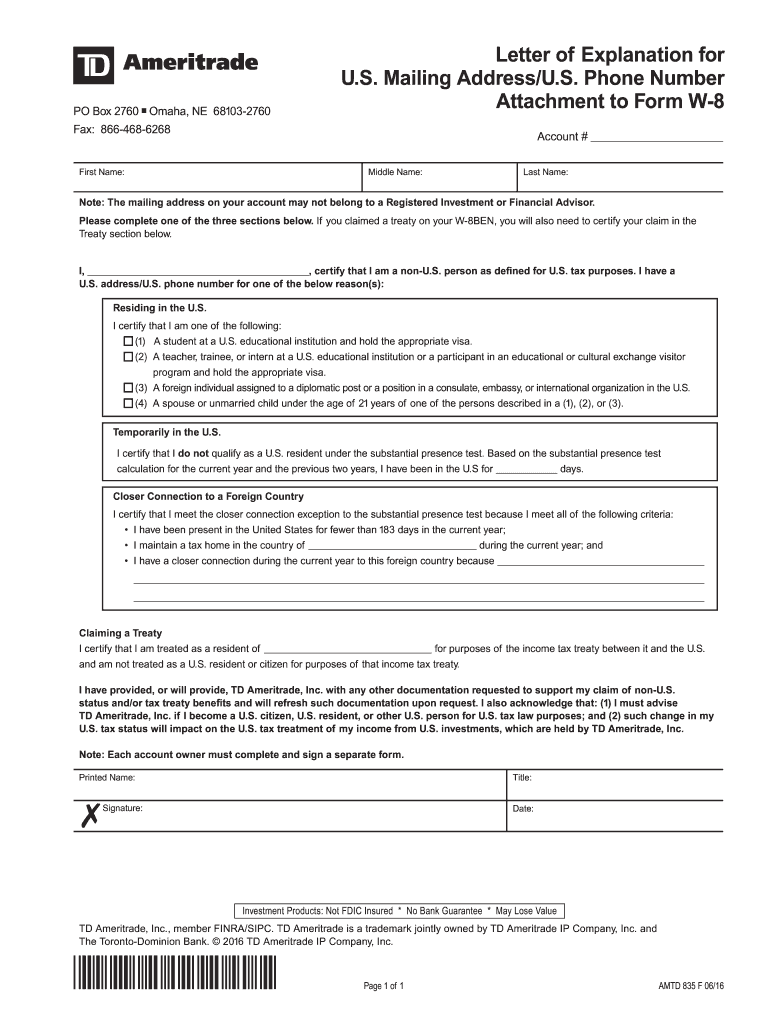

You must send Copies A of all paper Forms 1097 1098 1099 3921 3922 5498 and W-2G to the IRS with Form 1096 Annual Summary and Transmittal of US.

. Continue your return in TurboTax Online. TD Ameritrade provides a downloadable tax exchange format file containing your realized gain and loss information. TD Ameritrade does not provide tax advice.

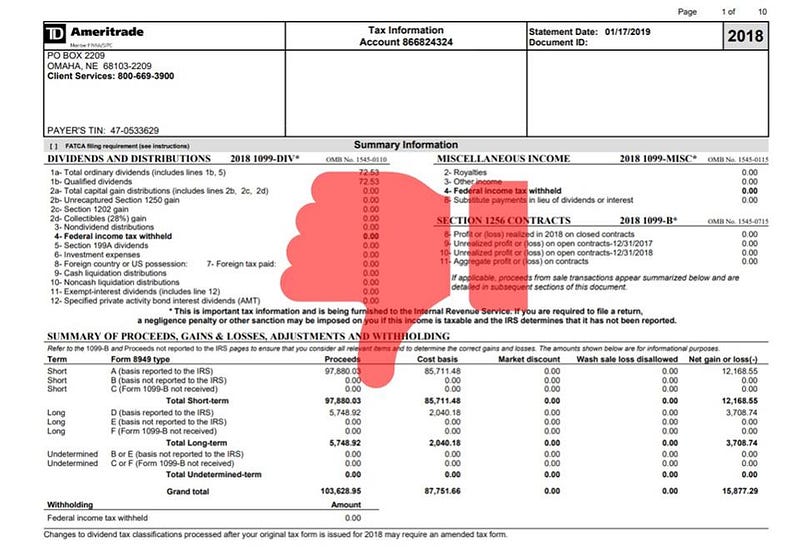

2nd Correction Cycle March 8 2017 Reports reclassified income that was reported to TD Ameritrade between 2152016 and 2282016. You must enter the gain or loss on sales of securities dividends and interest earned etc. You should have received your 1099 and 1098 forms.

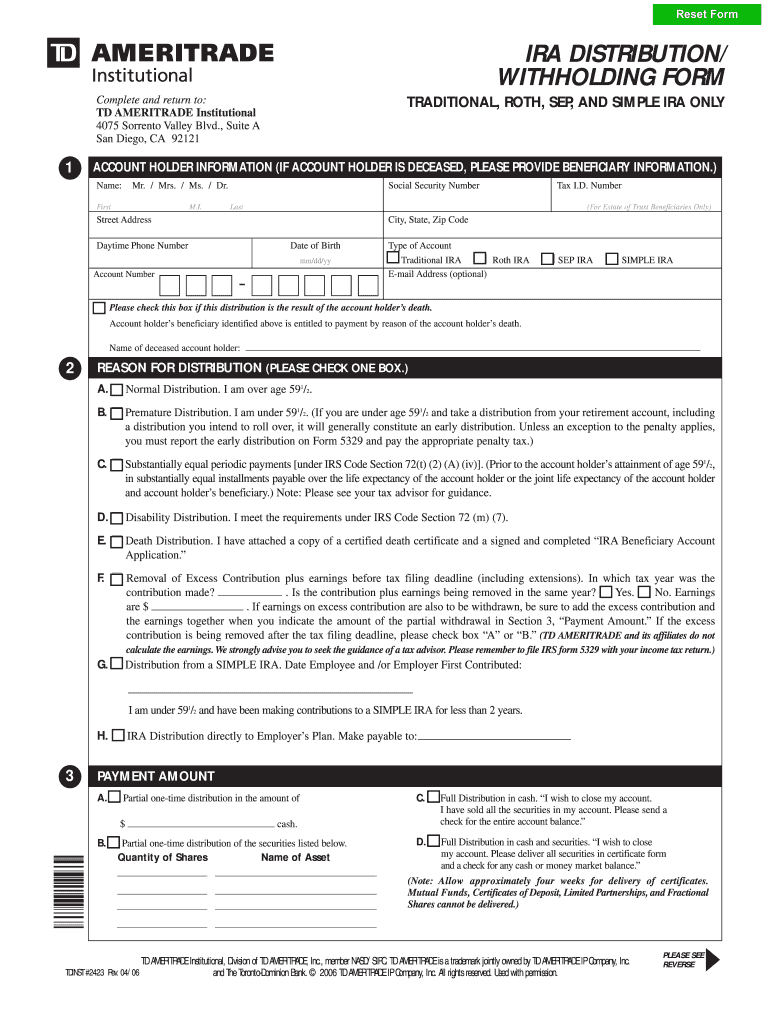

The form covers the following areas. Tax-free interest dividends from mutual funds or regulated investment companies RRECs are now pending. Do I need to report anything on my tax return if I havent withdrawn any funds from the account.

Tracking your cost-basis To figure out your gainloss you need to know the original value of the asset or cost basis including adjustments such as sales commissions or transaction fees. With the CPI report out of the way investors can focus on bank earnings this week. How are dividends reported on the New Form 1099.

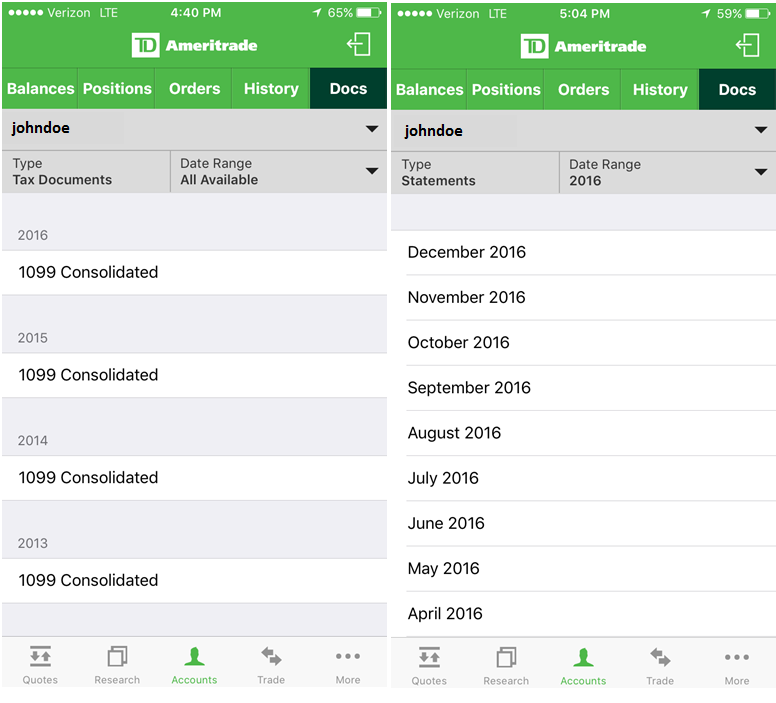

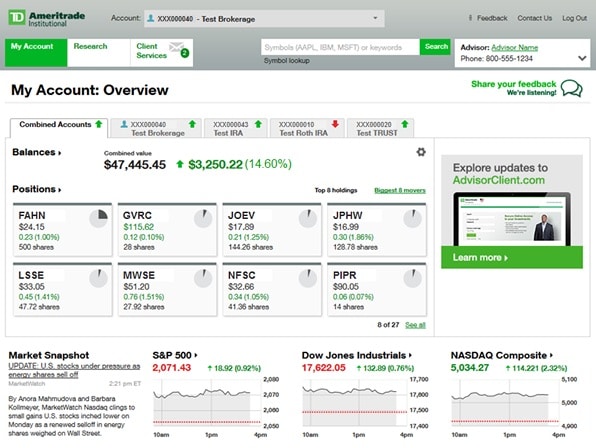

TD Ameritrade handles all taxable reporting for your clients accounts and the distribution of your clients tax documents. Click on the Tax Center menu item. 3rd Correction Cycle March 22 2017.

Regardless of whether you withdrew money from your account or not. Shawn Cruz Director of Derivative Strategy TD Ameritrade. Scroll down to Cost basis reporting provided by GAINSKEEPER Select 20XX with wash sale adjustments 8949.

Does TD Ameritrade provide tax documents. Get in touch Call or visit a branch Call us. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

Your 2022 tax return is due April 18 unless you request an automatic extension by this date. The Consumer Price Index CPI came in a little better than expected in many areas particularly core inflation. I recently opened an account with TD Ameritrade.

Does TD Ameritrade provide tax documents. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Jensen said the documents come in PDF format so you can view or download your statements from a computer laptop tablet or mobile device.

TDA will provide you with a form known as a Consolidated. You can import your 1099-B from TD Ameritrade because it participates in the TurboTax Partner program. But investors cant get too comfortable because lockdowns in China may keep inflation high.

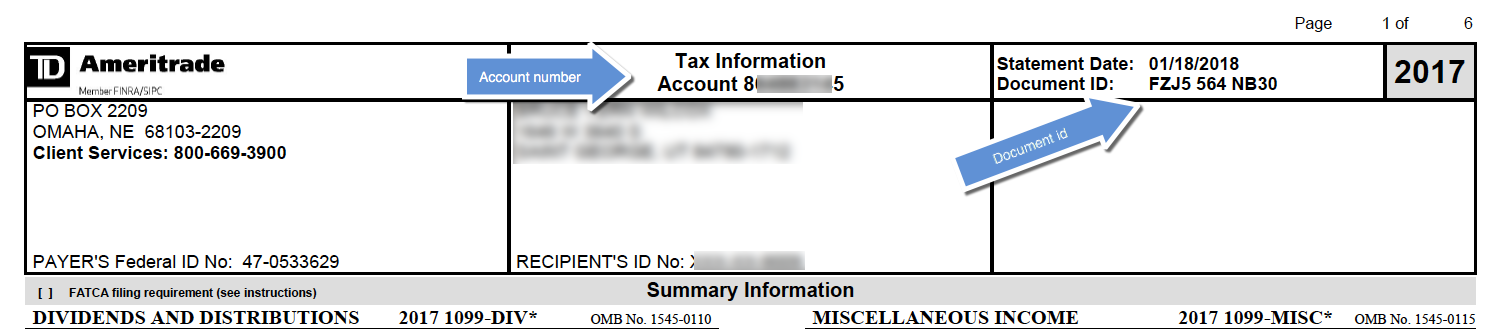

With TurboTax Its Fast And Easy To Get Your Taxes Done Right. 1099-INT forms are only sent out if the interest earned is at least 10. Your TD Ameritrade Consolidated Form 1099 Weve consolidated five separate 1099 forms into one comprehensive form containing information we report to the IRS.

Access the TD Ameritrade platform. TD Ameritrade clients can sign up for electronic delivery of tax documents and stop receiving paper documents. Select the My Account tab.

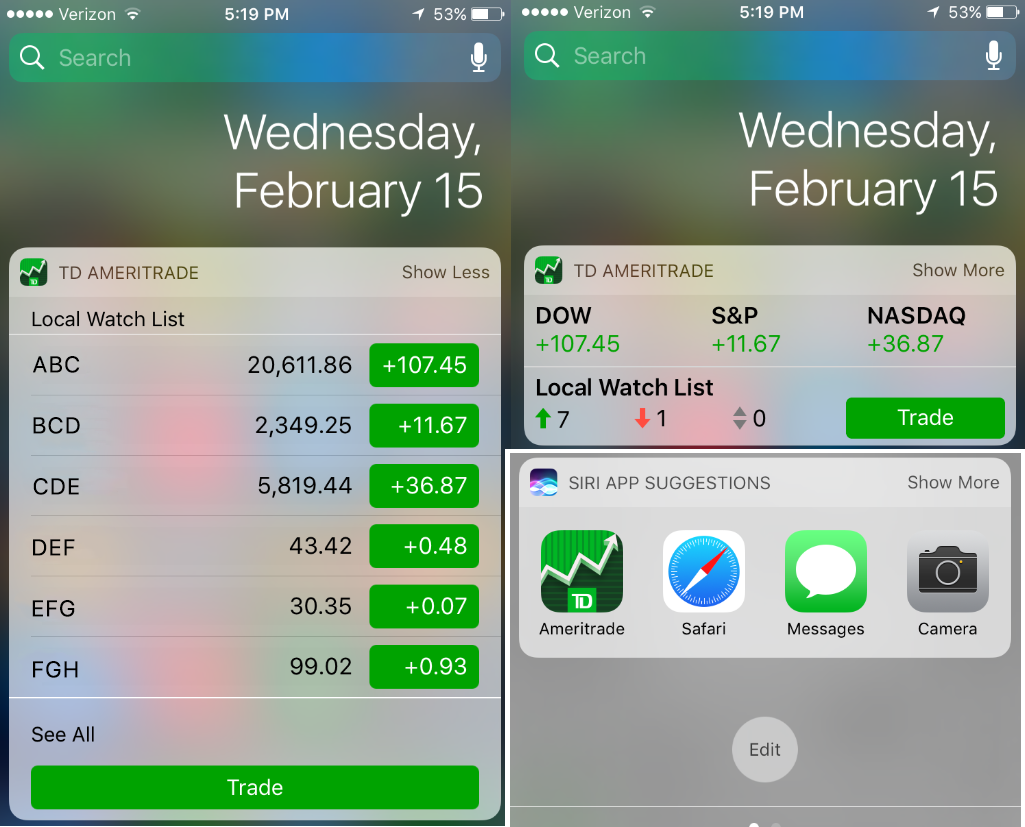

In the pop-up window select Topic Search. TD Ameritrade stores up to seven years of tax documents in your account and you can access these materials 24 hours a day wherever you are. Download this file and submit it for processing by our program.

If your return isnt open youll need to sign in and click Take me to my return Click Tax Tools lower left of your screen. Do you send 1099 forms to IRS. TD Ameritrade does not provide this form.

Your tax forms are mailed by February 1 st. The TD Ameritrade Mobile app now has up to 7 years of tax documents and 10 years of statements available from your iOS or Android device. Retrieve your tax documents or statements by navigating to Accounts selecting the account and navigating over to.

Interest Income Form 1099-INT reports all interest payments such as bond interest. TD Ameritrade stores up to seven years of tax documents in your account and you can access these materials 24 hours a day wherever you are. 175 Branches Nationwide Go City State Zip.

Reports reclassified income not captured on Consolidated 1099 forms to be issued in mid-February 2017 that was reported to TD Ameritrade between 292016 and 2142016. This section is very useful for information about reportable transactions tax documents availability tax reporting questions and RMD calculations just to name a few. Get Your Max Refund Today.

At this time it appears that Ameriprise has either. Your tax forms arrive at home. Since we did not make our move to TD Ameritrade until October of 2020 this means you will have documents from both Ameriprise and TD Ameritrade for the 2020 tax year.

Here is what we know. Be directed to your tax advisor. Tax documents are generated by a company like TD Ameritrade anytime you have an account for any part of the year.

Get all of your important tax filing forms all in one convenient place.

Get Real Time Tax Document Alerts Ticker Tape

Irs Form W 8ben Td Ameritrade 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

Tax Season And More Made Simpler With The Td Amerit Ticker Tape

Find Your 1099 On Td Ameritrade Website Tutorial Youtube

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

Ameritrade Ira Distribution Withholding Form Fill Online Printable Fillable Blank Pdffiller

How To Read Your Brokerage 1099 Tax Form Youtube

Td Ameritrade Ofx Import Instructions

Td Ameritrade Account Access Lifeguide Financial Advisors

Are You Considering These 4 Things When Choosing A Crypto Tax Software Cointracker

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Will I Get Tax Documents From Ameriprise And Td Ameritrade Hicks Associates

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape